𝐘𝐨𝐮 𝐂𝐚𝐧’𝐭 𝐁𝐞 𝐭𝐡𝐞 𝐍𝐞𝐱𝐭 𝐖𝐚𝐫𝐫𝐞𝐧 𝐁𝐮𝐟𝐟𝐞𝐭𝐭 — 𝐀𝐧𝐝 𝐓𝐡𝐚𝐭’𝐬 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞𝐥𝐲 𝐎𝐤𝐚𝐲.

May 15th, 2025 Blog

𝐘𝐨𝐮 𝐂𝐚𝐧’𝐭 𝐁𝐞 𝐭𝐡𝐞 𝐍𝐞𝐱𝐭 𝐖𝐚𝐫𝐫𝐞𝐧 𝐁𝐮𝐟𝐟𝐞𝐭𝐭 — 𝐀𝐧𝐝 𝐓𝐡𝐚𝐭’𝐬 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞𝐥𝐲 𝐎𝐤𝐚𝐲.

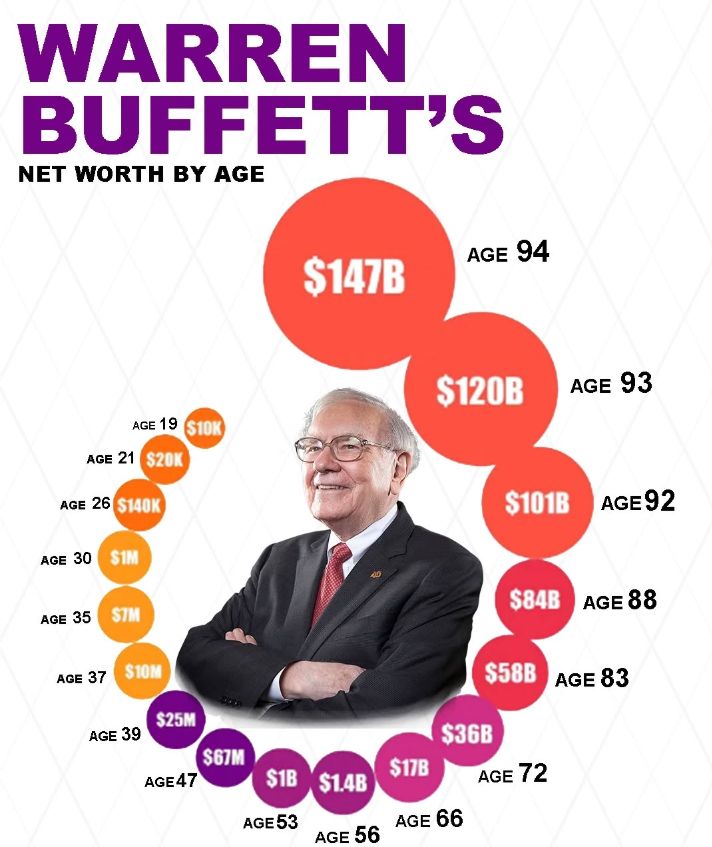

𝐖𝐞 𝐚𝐥𝐥 𝐚𝐝𝐦𝐢𝐫𝐞 𝐖𝐚𝐫𝐫𝐞𝐧 𝐁𝐮𝐟𝐟𝐞𝐭𝐭 — 𝐭𝐡𝐞 𝐎𝐫𝐚𝐜𝐥𝐞 𝐨𝐟 𝐎𝐦𝐚𝐡𝐚 — 𝐟𝐨𝐫 𝐛𝐮𝐢𝐥𝐝𝐢𝐧𝐠 𝐮𝐧𝐢𝐦𝐚𝐠𝐢𝐧𝐚𝐛𝐥𝐞 𝐰𝐞𝐚𝐥𝐭𝐡.

But here’s what most people overlook:

🔹 Started investing at 𝐚𝐠𝐞 𝟏𝟏

🔹 Compounded wealth at ~𝟐𝟎% 𝐚𝐧𝐧𝐮𝐚𝐥𝐥𝐲

🔹 Today, at 94 years old, 𝐡𝐞’𝐬 𝐰𝐨𝐫𝐭𝐡 $𝟏𝟔𝟗 𝐛𝐢𝐥𝐥𝐢𝐨𝐧

🔹 Among the 𝐓𝐨𝐩 𝟏𝟎 richest people on Earth

𝐒𝐨𝐮𝐧𝐝𝐬 𝐢𝐧𝐬𝐩𝐢𝐫𝐢𝐧𝐠, 𝐫𝐢𝐠𝐡𝐭?

But here’s a cold truth no one talks about 👇

🌍 𝐋𝐞𝐭’𝐬 𝐋𝐨𝐨𝐤 𝐚𝐭 𝐭𝐡𝐞 𝐎𝐝𝐝𝐬 — 𝐍𝐨𝐭 𝐭𝐡𝐞 𝐎𝐮𝐭𝐜𝐨𝐦𝐞

𝐀𝐜𝐜𝐨𝐫𝐝𝐢𝐧𝐠 𝐭𝐨 𝐔𝐍 & 𝐖𝐇𝐎 𝐝𝐚𝐭𝐚 (𝟐𝟎𝟐𝟒–𝟐𝟓), 𝐨𝐮𝐭 𝐨𝐟 𝟖.𝟏 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐩𝐞𝐨𝐩𝐥𝐞:

𝐀𝐠𝐞 𝐆𝐫𝐨𝐮𝐩 % 𝐨𝐟 𝐖𝐨𝐫𝐥𝐝 𝐏𝐨𝐩𝐮𝐥𝐚𝐭𝐢𝐨𝐧 𝐄𝐬𝐭𝐢𝐦𝐚𝐭𝐞𝐝 𝐏𝐞𝐨𝐩𝐥𝐞

80+ ~1.2% ~97 million

85+ ~0.5% ~40 million

90+ ~0.2% ~16 million

So…

🔸 Just 1.2% live 𝐩𝐚𝐬𝐭 𝟖𝟎

🔸 Only 0.2% live 𝐩𝐚𝐬𝐭 𝟗𝟎

𝐍𝐨𝐰 𝐩𝐚𝐮𝐬𝐞 𝐚𝐧𝐝 𝐭𝐡𝐢𝐧𝐤:

👉 How many people start investing by age 11 (or even 20)?

👉 Compound at 20% CAGR?

👉 And actually live beyond 90 to see the full impact?

🧊 𝐓𝐡𝐞 𝐨𝐝𝐝𝐬? 𝐒𝐭𝐚𝐭𝐢𝐬𝐭𝐢𝐜𝐚𝐥𝐥𝐲 𝐧𝐞𝐠𝐥𝐢𝐠𝐢𝐛𝐥𝐞.

🧠 𝐃𝐨𝐧’𝐭 𝐁𝐞 𝐁𝐮𝐟𝐟𝐞𝐭𝐭. 𝐉𝐮𝐬𝐭 𝐓𝐡𝐢𝐧𝐤 𝐋𝐢𝐤𝐞 𝐇𝐢𝐦.

Chasing Buffett’s outcomes is unrealistic.

But following his principles? That’s achievable.

✅ Stay invested

✅ Avoid get-rich-quick traps

✅ Be patient

✅ Trust compounding

💡 𝐘𝐨𝐮 𝐝𝐨𝐧’𝐭 𝐧𝐞𝐞𝐝 𝐁𝐮𝐟𝐟𝐞𝐭𝐭’𝐬 𝐥𝐢𝐟𝐞 𝐬𝐩𝐚𝐧 𝐭𝐨 𝐛𝐮𝐢𝐥𝐝 𝐰𝐞𝐚𝐥𝐭𝐡—𝐲𝐨𝐮 𝐣𝐮𝐬𝐭 𝐧𝐞𝐞𝐝 𝐡𝐢𝐬 𝐦𝐢𝐧𝐝𝐬𝐞𝐭.

💭 𝐋𝐞𝐭’𝐬 𝐌𝐚𝐤𝐞 𝐓𝐡𝐢𝐬 𝐅𝐮𝐧:

💰 If you invested ₹1 lakh at age 11 and compounded it at 20% annually till age 94… How much would you have today?

📉 𝐇𝐢𝐧𝐭: 𝐘𝐨𝐮𝐫 𝐜𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐨𝐫 𝐦𝐢𝐠𝐡𝐭 𝐩𝐚𝐧𝐢𝐜

🧠 Excel users, this one’s your time to shine. 💻📈

👇 Drop your best guess in the comments!